missouri vendor no tax due certificate

You will only need to provide your contact information once by signing up for a MyTax Missouri account. Current vendor no tax due letter from the missouri department of revenue.

Watkins Home Business Independent Watkins Consultant Eleisia Whitney Sign Up At Http Www Respect Home Business Opportunities Business Home Based Business

A Certificate of No Tax Due is NOT sufficient.

. To search for a business with a revoked sales tax license you may search by Business. My attention at 660-543-8345. If you are requesting a No Tax Due use No Tax Due Request Form 5522.

This portal also includes a Vendor Payment Search feature to search for payments to your account from the State. Obtain a vendor no tax due certificate from the missouri department of revenue by following the procedures outlined below. Obtain a vendor no tax due certificate from the missouri department of revenue by following the procedures outlined below.

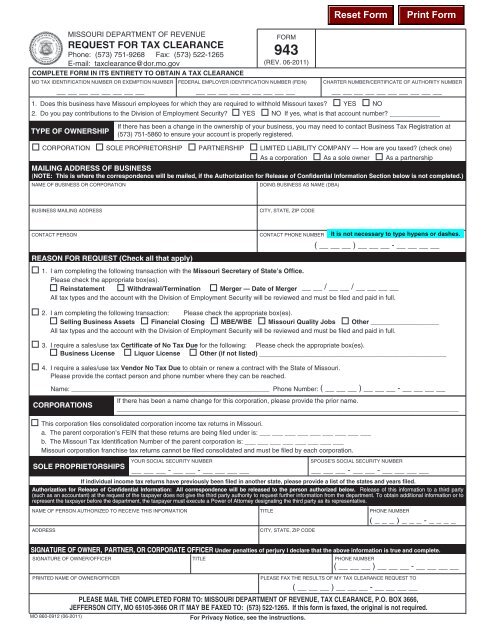

Have a valid registration with the Missouri. Information available at httpdormogovforms943pdf. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri.

The letter verifies that there is no need of registration for salesuse tax because you are not going to make taxable sales in Missouri. Missouri Department of Revenue Tax Clearance Unit at 573 751-9268. I require a sales or use tax Certificate of No Tax Due for the following.

File a Vendors Use Tax Return - Contact Information. Reason For No Tax Due. The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail.

Jones has sales tax delinquencies totaling 20000 which he must pay because. If taxes are due depending on the payment history of the business a cashiers check or money order may be required for payment before a certificate of no tax due can be issued. This portal includes links to the Vendor InputACH-EFT form that is used for adds deletes and changes and enables electronic transfer of funds from State to vendor.

Mail Fax Taxation Division. If you do not provide the Vendor No Tax Due certificate andor maintain a compliant tax status it may render your company unacceptable for further consideration for University of Central Missouri contracts. Jones for a Certificate of No Tax Due.

If a business license is not required submit a statement of explanation. The individual must be authorized to discuss the confidential information provided in the return. If the business is properly registered and does not owe any Missouri sales or withholding tax this site will allow you to print your own Certificate of No Tax Due which you can present to the local or state agency.

Make sure both the FEIN and state EIN are included on the letter. Tax Clearance please fill out a Request for Tax Clearance Form 943. You may obtain a Vendor No Tax Due certificate by contacting the Missouri Department of Revenue.

A business may have its sales tax license revoked for failure to remit sales tax collected from its customers to the Department of Revenue or for failure to remit income taxes withheld from its employees to the Department of Revenue. If a city county or state agency has enrolled with the Missouri Department of Revenue they will be able to determine if a business has no tax due without requiring a piece of paper to be issued by the Department of Revenue. Number and receives it.

If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

What is vendor no tax due certificate. How to use sales tax exemption certificates in Missouri. If you need.

Select all that apply. You must provide the contact information for the individual filing this return. A business that makes no retail sales is not required by section 144083 rsmo to present a certificate of no tax due in order to obtain or renew.

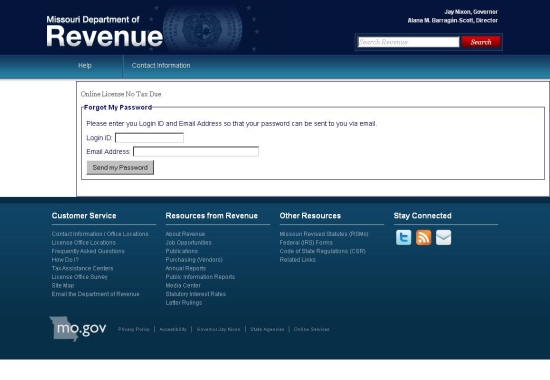

Search Who is Not Paying. R Business License r Liquor License r Other if not listed _____ 4. Please enter your MOID and PIN below in order to obtain a statement of No Tax Due.

The fax number is 573 522-1265. Missouri Vendor No Tax Due Certificate. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

A Vendor No Tax Due can be obtained by contacting. Current Vendor No Tax Due letter from the Missouri Department of Revenue. Missouri no tax due statements available online.

Receive this information Title. Smith comes in to apply for a Missouri Tax ID. In order for the business owner or authorized representative to obtain a no tax due through the online system the business must.

1 a copy of the missouri sales and use tax exemption certificate and2 their university identification card. Jones after receiving his license for the business he finds Mr. If you have questions concerning the tax clearance please contact the.

If you have questions concerning reinstatements please contact the. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due. Smith did not obtain a Certificate of No Tax Due from Mr.

How To Register For A Sales Tax Permit In Missouri Taxvalet

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

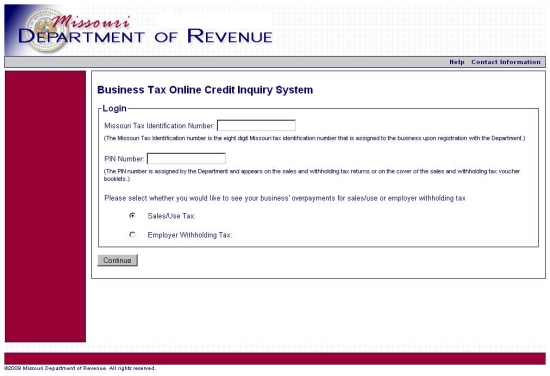

Sales Use Tax Credit Inquiry Instructions

Generic Employment Application How To Create A Generic Employment Application Download Employment Application Job Application Template Job Application Form

Sales Use Tax Credit Inquiry Instructions

943 Request For Tax Clearance Missouri Department Of Revenue

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Sales Use Tax Credit Inquiry Instructions

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Missouri No Tax Due Statements Available Online

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Get A Certificate Of No Tax Due For Next Hotel Purchase Texas Hotel Lodging Association

Generic Employment Application How To Create A Generic Employment Application Download Employment Application Job Application Template Job Application Form